payroll outsource services for small businesses and startup.

Welcome to Simplista Financial your revenue growth and trusted partner in payroll outsourcing services for small business and startup. We understand the challenges faced by businesses in today’s fast-paced world.

That’s why we’re dedicated to providing tailored payroll solutions that meet your unique needs, allowing you to focus on what matters most – growing your business.

Challenges Faced by Businesses:

In the ever-evolving landscape of payroll tax compliance, businesses encounter a myriad of challenges that can hinder productivity and growth. From navigating complex regulations to ensuring timely and accurate reporting, the demands of payroll management can be overwhelming. Here are some common obstacles faced by businesses:

-

Real-Time Information (RTI) Compliance:

Keeping pace with HMRC’s RTI requirements is essential for businesses to avoid penalties and maintain compliance. However, the intricacies of real-time reporting can be daunting, especially for startups and small businesses with limited resources.

-

Construction Industry Scheme (CIS) Obligations:

For businesses operating in the construction industry, compliance with the CIS presents additional challenges. Managing subcontractor tax deductions, verifying status, and submitting monthly CIS returns require meticulous attention to detail and expertise.

-

Annual Returns and P11Ds:

Year-end payroll reporting, including the submission of P60s and P11Ds, adds another layer of complexity for businesses. Ensuring accuracy and timeliness in these submissions is paramount to avoid penalties and maintain regulatory compliance.

Penalties and Compliance Risks:

Failure to address these challenges effectively can result in severe consequences for businesses, including:

-

Financial Penalties:

HMRC imposes penalties for late or incorrect RTI submissions, CIS non-compliance, and errors in annual returns. These penalties can accumulate over time, leading to significant financial strain for businesses.

-

Reputational Damage:

Compliance failures can tarnish a business’s reputation and erode trust among clients, partners, and employees. Negative publicity stemming from compliance issues can undermine brand credibility and hinder business growth.

-

Legal Ramifications:

Persistent non-compliance with payroll tax regulations may attract legal action from HMRC, resulting in litigation costs, court fines, and potential business closures.

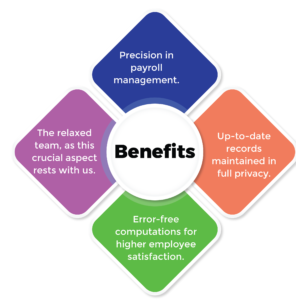

Our Tailored Solutions:

We’re committed to helping businesses overcome payroll challenges with confidence.

Our comprehensive range of services includes:

-

RTI Compliance Management:

We handle all aspects of RTI reporting, ensuring timely and accurate submissions to HMRC, and mitigating compliance risks.

-

CIS Administration:

- Our experts navigate the complexities of the CIS, from subcontractor verification to monthly returns, ensuring compliance and peace of mind for construction businesses.

-

Annual Returns and P11D Preparation:

We streamline year-end reporting processes, collating and submitting payroll data accurately and efficiently, to meet HMRC deadlines.

Startup-Friendly Approach:

We understand the financial constraints faced by new businesses. That’s why we offer competitive pricing and special incentives for startups, including reduced rates for the initial years of service. Partner with us to unlock the benefits of professional payroll outsource services at affordable prices, tailored to your startup’s needs.

Conclusion:

Don’t let payroll tax complexities hold your business back. To find payroll services in the UK & London trust us to deliver reliable, cost-effective payroll solutions that empower your business to thrive.

Contact us today to learn more about how we can support your payroll needs and propel your business towards success!